It is not clear that such frequent professional service is needed as long as you are diligent about the most important maintenance task: replacing air filters whenever they get dirty. Heating and air-conditioning services are likely to push for annual professional maintenance visits, and many will offer a maintenance contract. Carefully compare their proposed designs because the quality of the design might affect how quickly and uniformly your house is heated or cooled, how much energy it consumes, how much noise it makes, what drafts it produces, the amount of space the system occupies, maintenance, and other important aspects of performance. If you need new equipment, get several companies to prepare written proposals. Although most consumers, surprisingly, don’t bother to get competitive bids even for costly jobs, obtaining multiple bids will save homeowners hundreds, or even thousands, of dollars. But some scored much lower, receiving such favorable ratings from only 60 percent or fewer of their surveyed customers. Some companies were rated “superior” for “overall performance” by 90 percent or more of their surveyed customers. Do you need any more checks, check registers, return address labels, or a new checkbook cover? Current Catalog has a variety of novelty checking essentials for you to browse online.Our Ratings Tables show how area heating and air-conditioning services were rated by their surveyed customers. While you’re thinking of your checking account, take a quick inventory. Plus, you can sync several accounts together - perfect for spouses who use one another’s accounts regularly.

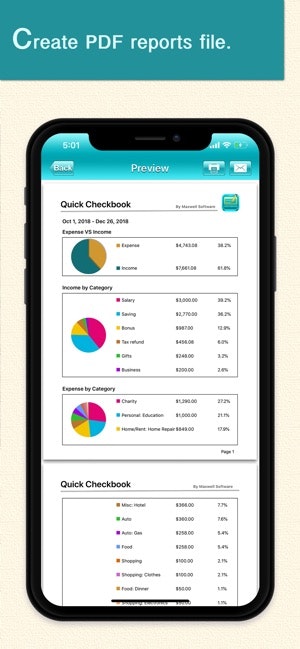

ClearCheckbook stores information in the cloud, so it can be used on your smartphone, tablet, and desktop computer, making it easy to access your financial information from a variety of sources. Schedule bill payments ahead of time, get email reminders of upcoming bills, and track how you spend with this nifty app. As a bonus, you can add photos of receipts to make record keeping paperless! ClearCheckbook: It’s perfect for small business accounts since the data can easily be transferred to Quicken, Excel, and other accounting programs. Keep things simple and manage daily expenses and incoming cash with this easy app. You can include as many accounts as you want, rollover extra money from one month to the next, and see your stats in various currencies - which is perfect for avid travelers! QuickBank Checkbook: This Android-based app lets you see all your financial information, including retirement investment totals and trading options, in addition to your personal checking and savings accounts details. This is crucial if you’re trying to develop a budget or overhaul your current retail therapy habits in addition to balancing your checkbook. WalletWhiz:ĭoes your entire life revolve around a calendar? Then so should your finances! WalletWhiz has a calendar view that makes it easy to see spending patterns based on days of the week. You can also set up a savings program so the money is automatically withdrawn and deposited into savings before you can spend a dime. You can set up budgets for everything from utility bills to how much you want to spend each pay period on dining out or buying clothes.

Intuit’s financial app, Mint, makes it easy to stay on top of your cash flow. Whew! That’s a lot of transactions to keep track of! Thankfully there are plenty of apps for balancing your checkbook and keeping your finances up-to-date so you can instantly review your deposits and payments. You slide your debit card at the coffee shop, mail a check for the monthly mortgage, pay the credit card bill online, and get your paycheck auto deposited.

0 kommentar(er)

0 kommentar(er)